12 days until the tax filing deadline!

Start your return today to get your biggest refund, guaranteed*.

Taxes done right, however you choose

File your own taxes

Answer simple questions, and we’ll guide you through filing your taxes.

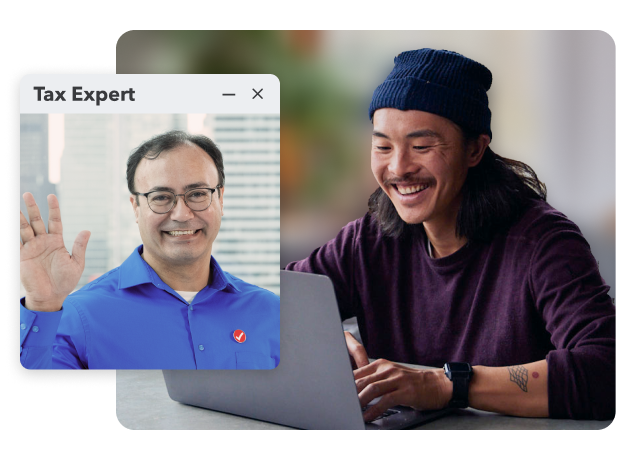

Live tax experts can help

Get advice and answers as you go, with a final expert review before you file.

We do your taxes for you

Have a dedicated tax expert handle everything, from start to finish.

Hand off your taxes to a real tax expert

Get matched with the best tax expert for your unique tax situation, who will get your taxes done for you, done right, and done.

Our team of tax experts has on average 10 years of professional experience doing taxes (as of January 2023).

From getting your CRA tax slips to making sure you claim all eligible deductions, your tax experts are fully at your service.

Your expert will walk you through your finished tax return so you’re confident everything is done right.

See what customers are saying

Includes reviews for TurboTax from previous years.

Your satisfaction, guaranteed

Rated number 1 in Canada

More than 50 million returns have been filed with TurboTax

NETFILE certified

Your tax return is securely submitted directly to the CRA with just one click. You'll get your refund fast - in as few as 8 business days.

100% accurate —guaranteed

Our calculations are 100% accurate and your taxes will be done right, guaranteed, or we’ll reimburse you any CRA penalties

Full Service

Full Service